Soft Credit Checks

Without Risk

Prequalify Your Customers Instantly

Say yes faster and turn browsers into buyers using verified tri-bureau data without hurting consumer credit scores.

Ideal Solutions for Key Lending Scenarios

Prequalify

With Confidence

For personal, home, auto financing,

or debt consolidation.

Optimize

Every Lead

FIncrease lead conversions and manage

funnel performance for more funded loans.

Trust

In Every Decision

Faster approvals. Fewer drop-offs.

Better loans.

Drive More Conversions. Reduce Risk.

With Soft Pulls’ Credit Data - no score impact, you can:

-

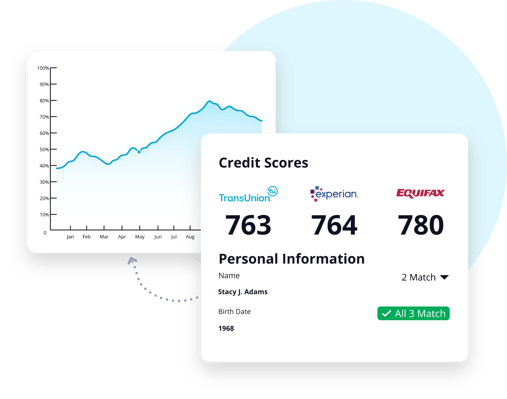

Access 3-Bureau Credit Reports & FICO®️ Scores

-

Eliminate friction and shorten approval times

-

Protect data security with an FCRA Compliant Partner

-

Save money and time with bundle pricing plans and personalized support

-

Integrate quickly with CRM and lead-gen platforms

-

Convert declines into future loyal customers by providing patented credit education tools

A Brand You Can Trust

You’re backed by the same trusted technology and customer service that powers SmartCredit®, relied on by millions* of consumers and partners nationwide.

Now, we’re helping businesses like yours turn faster decisions into lasting loyalty.

Copyright © 2026, ConsumerDirect®, Inc.. Term of Use

IMPORTANT DISCLAIMER: Any credit scores, plus points, ScoreBuilder® points, or ScoreBoost™ points shown or inferred are estimates only. Individual results may vary, and results are not guaranteed. ScoreBuilder® is an individual communications tool using our patented Action button where all requests taken by an individual are sent direct-to-creditor customer service. ScoreBoost™ is a payment and spending simulation based on credit utilization. Credit score changes are also estimates only and typically apply to all credit scores similarly including FICO® & VantageScore® versions as credit scores are derived from TransUnion®, Experian® and Equifax® where your payments and spending are reported, and credit utilization is used for scoring.